Hourly gross pay with overtime calculator

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. Ad Create professional looking paystubs.

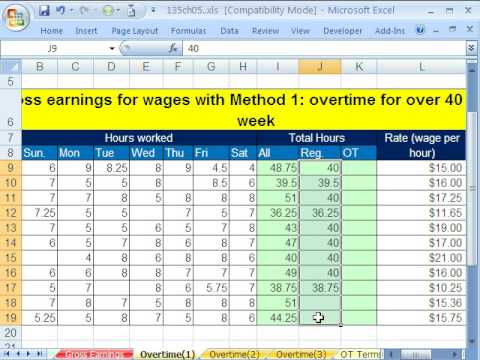

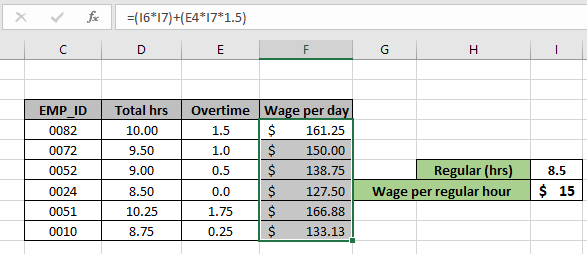

Excel Formula Basic Overtime Calculation Formula

In a few easy steps you can create your own paystubs and have them sent to your email.

. See where that hard-earned money goes -. Annual Salary Bi-Weekly Gross 14 days. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

Hourly Wage Tax Calculator 202223. Ad GetApp Has Helped More Than 18 Million Businesses Find The Perfect Software. Gross Pay Calculator.

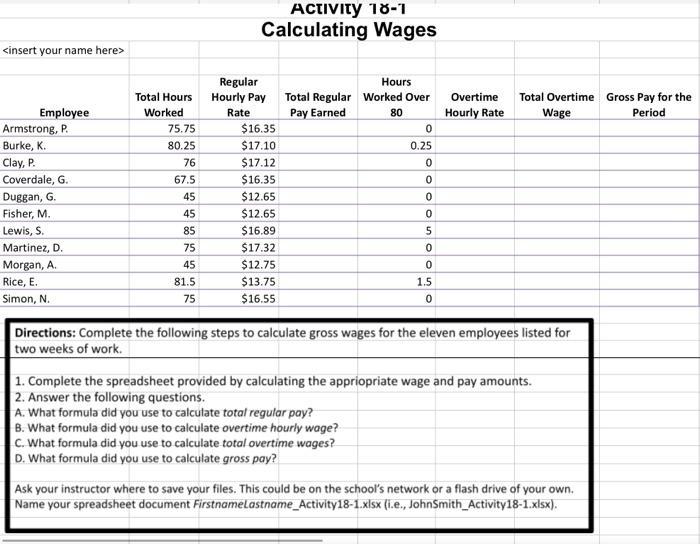

The basic overtime formula is Hourly Rate Overtime Multiplier Number of Overtime Hours worked in a particular week. Next divide this number from the. For salaried employees the regular.

30 x 15 45 overtime. All Services Backed by Tax Guarantee. 365 days in the year please use 366 for leap years Formula.

Get Your Quote Today with SurePayroll. You can claim overtime if you are. 1200 40 hours 30 regular rate of pay.

The overtime calculator uses the following formulae. If an employee worked 40 regular hours and 10 overtime hours in one week with a regular pay rate of 20 per hour the calculation would look as follows. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Gross Pay Hours Hourly Wage Overtime Hours Hourly Wage 15 Commission Bonuses. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

How to calculate overtime pay. How do I calculate hourly rate. Calculating Annual Salary Using Bi-Weekly Gross.

See where that hard-earned money goes - Federal Income Tax Social Security and. 40 regular hours x 20. Get Started Today with 2 Months Free.

All other pay frequency inputs are assumed to be holidays and vacation. We calculate Tanias overtime pay as follows. This number is the gross pay per pay period.

Get the Attendance Tools your competitors are already using - Start Now. Ad Payroll So Easy You Can Set It Up Run It Yourself. If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for working overtime.

Many cities and villages in Ohio levy their own municipal income taxes. Subtract any deductions and. In fact 848 municipalities have their own income taxes.

We use the most recent and accurate information. Gross Pay Hourly Formula. 14 days in a bi-weekly pay period.

This overtime calculator figures your total overtime paycheck and the OT rate together with the regular pay by taking account of the number of hours worked.

Excel Busn Math 38 Gross Pay And Overtime 5 Examples Youtube

Gross Pay And Net Pay What S The Difference Paycheckcity

Pay Calculator With Taxes Online 51 Off Www Ingeniovirtual Com

Gross Pay Calculator Online 59 Off Www Ingeniovirtual Com

Solved Activity 18 1 Calculating Wages Insert Your Name Chegg Com

Overtime Calculator To Calculate Time And A Half Rate And More

Gross Pay And Net Pay What S The Difference Paycheckcity

How To Calculate Overtime Pay From For Salary Employees Youtube

Gross Pay Calculator Clearance 55 Off Www Ingeniovirtual Com

How To Calculate Gross Pay Youtube

Overtime Calculator Workest

Excel Formula Timesheet Overtime Calculation Formula Exceljet

Overtime Calculator

Paycheck Calculator Take Home Pay Calculator

How To Calculate Overtime Earnings From Hourly Pay Rate Formula For Calculating Overtime Pay Youtube

Calculate Overtime Amount Using Excel Formula

How To Calculate Gross And Overtime Pay In Microsoft Excel Microsoft Office Wonderhowto